Please Sign in to view recently saved searches.

Brazil is located in the southeast of South America. It is bordered by French Guiana, Suriname, Guyana, Venezuela and Colombia to the north, Peru and Bolivia to the west, Paraguay, Argentina and Uruguay to the south, and the Atlantic Ocean to the east.

The official language of Brazil is Portuguese. English and Spanish are the main foreign languages.

The currency of Brazil is the real. There are two legal foreign exchange markets, namely the commercial foreign exchange market and the tourism foreign exchange market. Brazil adopts a floating exchange rate system.

Brazil has 29 minerals such as niobium, manganese, titanium, bauxite, lead, tin, iron, uranium, etc., whose reserves rank among the top in the world. The proven reserves of niobium ore are 5.2 million tons, and the output accounts for more than 90% of the global total output. The proven reserves of iron ore are 3.33 billion tons, ranking fifth in the world, and the output ranks second in the world. The proven reserves of oil are 1.53 billion barrels, ranking 15th in the world.

【Agriculture】

In 2022, the export value of agricultural products in Brazil was $1590.9 billion, accounting for 47.6% of the total export value of Brazil. The export volumes of soybeans, sucrose, orange juice, tobacco, alcohol, beef and chicken in Brazil rank first in the world, and the export volumes of corn, cotton, coffee, soybean meal, soybean oil, peanut oil and pork rank among the top in the world.

【Industry】

The main industrial sectors in Brazil include: steel, automobiles, shipbuilding, oil, cement, chemical, metallurgy, electricity, construction, textile, shoemaking, papermaking and food processing, etc. The civil regional aircraft manufacturing industry and the biofuel industry are at the leading level in the world.

In 2022, according to the data of the National Confederation of Industry in Brazil, the export value of the manufacturing industry in Brazil reached $1814 billion, accounting for 54% of the total export value of Brazil.

【2023 Brazil's Export and Import Data】

In 2023, the export value reached $3396.7 billion, an increase of 1.7% compared with 2022, the export volume increased by 8.7%, while the price decreased by 6.3%. In 2023, the import value decreased by 11.7% to $2,408.3 billion. The price of imported goods decreased by 8.8% and the import volume decreased by 2.6%. In 2023, the total number of export enterprises increased by 2% to 28,500, also reaching a historical high.

In 2023, the main destination of Brazilian products was China. The export to this Asian giant reached $1057.5 billion, an increase of 16.5% compared with 2022. This is the first time in the history of Brazil's foreign trade that the export to a single trading partner has exceeded $1000 billion. Among the countries with increasing sales, the export value to Argentina increased by 8.9% compared with 2022, totaling $167.2 billion. The other two main partners, the United States and the European Union, decreased by 1.5% and 9.1% respectively. The import volumes of three of these four partners decreased: the United States (-26%), China (-12.4%) and Argentina (-8.4%). At the same time, Brazil's purchases from the European Union increased by 2.6% to a total of $454.2 billion, with the purchases from France, Germany and Italy being the most prominent.

In 2023, the trade flow (exports + imports) was $5805.07 billion, a decrease of 4.3% compared with 2022.

In 2023, the export growth was mainly driven by agriculture (9%) and the extractive industry (3.5%), while the total sales of the manufacturing industry decreased by 2.3%. Among these three industries, the products with the most prominent growth in foreign sales were live animals, corn, soybeans, ores, sugar, animal feed as well as civil engineering installations and equipment.

The Asian continent was the largest buyer of Brazilian products in 2023, mainly importing soybeans, corn, sugar, iron ore and crude oil.

As for imports, all three industries showed a decline, with agriculture decreasing by 21%, the extractive industry decreasing by 27% and the manufacturing industry decreasing by 10%. The main declines were in the purchases of wheat and rye, corn, latex, potatoes, coal, oil, gas, fuel and fertilizers, etc.

【2024 Brazil's Foreign Trade】

On September 18, 2024, the Brazilian Foreign Trade Commission approved an increase in the import tax on 30 chemical products from the original minimum tariff rate of 7.6% to 20%, and the measure is valid for 1 year. According to the data released by the association, in May 2024, the idle rate of domestic petrochemical plants in Brazil reached a historical high of 58%. To boost the local industry, the association asked the government to increase the import tariffs on 65 chemical products. Although the Brazilian government has only taken measures on less than half of the chemicals for the time being, the association believes that the effect will be "immediate", and it is expected that domestic products in Brazil can be restored to 80% of the level in the next few months.

In September 2024, up to the 3rd week, Brazil's exports totaled US$ 20.4 billion and imports US$ 16.9 billion.

From January to the third week of September, exports totaled US$247.5 billion and imports US$189.9 billion. The surplus is US$57.6 billion and the trade flow is US$437.3 billion.

In the accumulated period up to the 3rd week of September/2024, the performance of exports in the sectors, based on the daily average, showed a drop of US$ 55.4 million (16.9%) in Agriculture and US$ 110.79 million (28.6%) in Extractive Industry, but growth of US$ 95.64 million (13.5%) in Manufacturing Industry products.

In imports, the performance by daily average showed growth of US$ 2.87 million (14.8%) in Agriculture; US$ 29.76 million (56.1%) in Extractive Industry and US$ 120.42 million (13.4%) in Manufacturing Industry products.

【Blooming Trade Data】

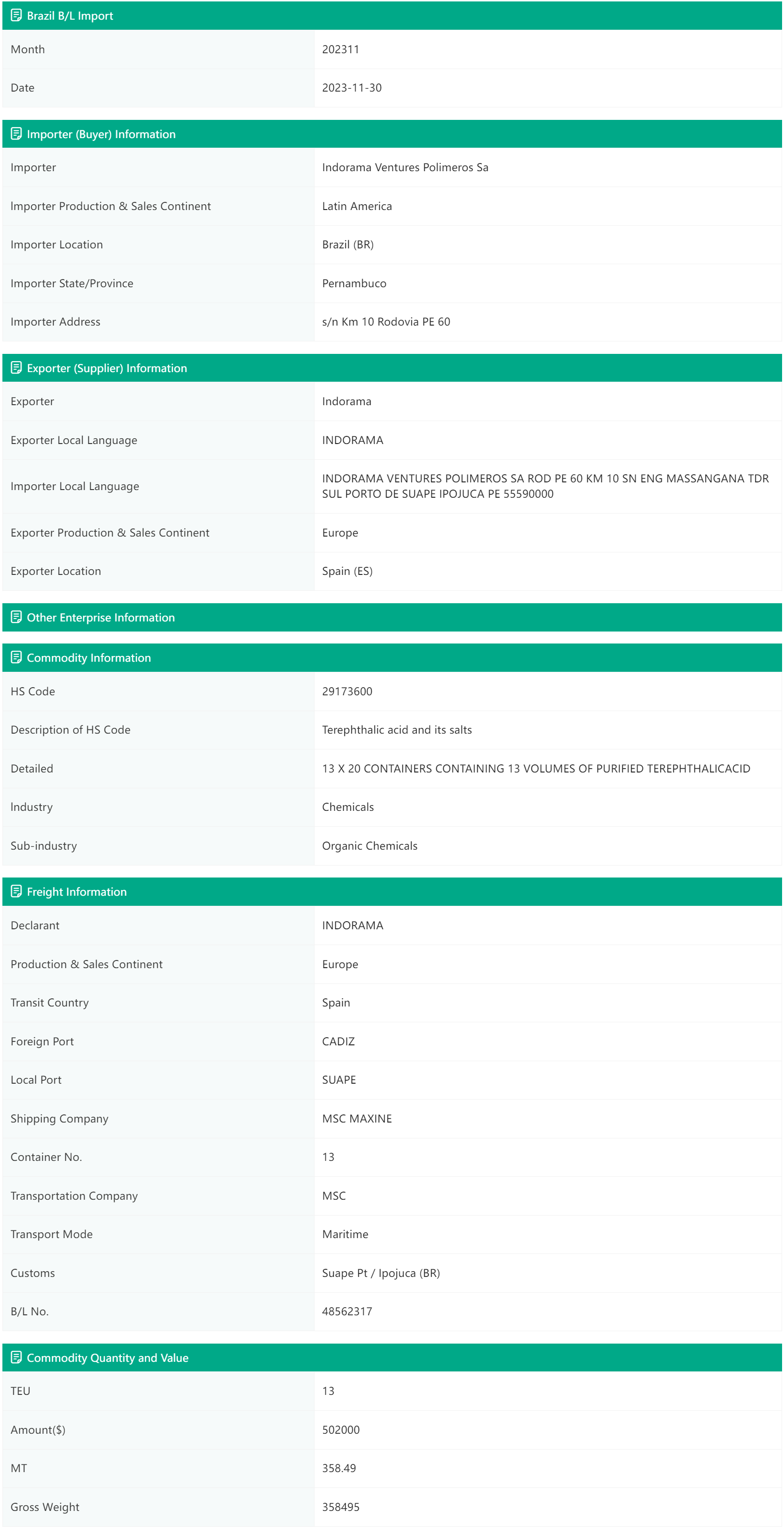

Brazilian bill of lading data includes important information about buyers, sellers, commodity, freight, and major quantity and price information such as purchase quantity and purchase amount.

Do you want to understand the market demand in Brazil? Are you looking to expand your international market presence in Brazil? Are you seeking more cooperation with clients and reliable suppliers in Brazil?

Sample Data