Global Shipping Insights September: Latest on Maritime Routes, Airlines, and Port Data

Global Shipping Insights September: Latest on Maritime Routes, Airlines, and Port Data

September Sees Continued Global Air Cargo Growth, with Moderate Year-on-Year Increase

In September, global air cargo demand remained high, though the year-on-year growth rate showed a slight decrease. According to IATA, air cargo demand grew by 9.4% compared to the previous year, with capacity up by 6.4% and the average cargo load factor rising to 45.6%. This represents a modest slowdown from the double-digit growth recorded over the first nine months of 2024. Despite this, yields improved by 11.7% year-on-year. Regionally, cargo demand for airlines in the Asia-Pacific and Europe both increased by 11.7%, North America saw a 3.8% rise, the Middle East grew by 10.1%, and Latin America led with a 20.9% increase, while Africa saw the slowest growth at 1.7%. International route demand rose by 10.5%, driven by rising e-commerce demand from the U.S. and Europe amid limited ocean shipping capacity.

Record Transits Expected for Northern Sea Route in 2024

According to the Arctic Logistics Hub at Norway's Northern University, the number of transits via the Northern Sea Route (NSR) in 2024 is expected to hit a record high, with most cargo moving between Russia and China. Data shows approximately 2.4 million tons of cargo completed NSR transits in the first three quarters of 2024, spanning 79 journeys, with 95% of this volume going from Russia to China. Crude oil made up 62% of this volume (approximately 1.47 million tons), bulk cargo 27% (64.6 million tons), and container goods 6% (15.3 million tons). CHNL notes that these transits include 28 trips from Russia to China, 26 from China to Russia, and 25 within Russian ports, with 46 of the voyages carrying cargo (31 eastbound, 15 westbound), while the remaining 33 voyages were empty.

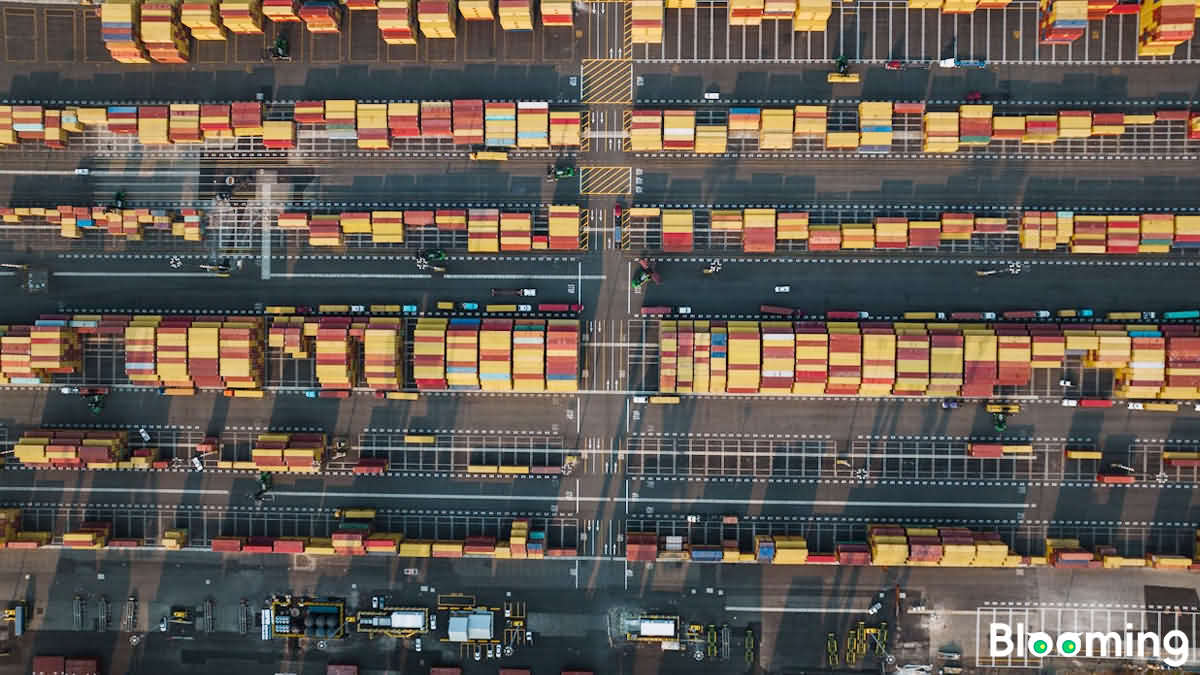

China's Ports Handle 12.97 Billion Tons in the First Three Quarters of 2024

China's Ministry of Transport reported that in the first three quarters of 2024, China's transportation economy remained steady, with improvements in freight volume, port throughput, and cross-regional passenger movement. Chinese ports handled 12.97 billion tons of cargo, a year-on-year increase of 3.4%. Domestic cargo throughput rose by 1.7%, and foreign trade throughput rose by 7.6%. Container throughput reached 250 million TEUs, up 7.7%.

Air Canada Cargo Revenue Grows 18% Year-Over-Year in Q3

In the third quarter of 2024, Air Canada’s cargo revenue reached 253 million CAD, marking an 18% year-over-year increase. This growth was driven primarily by strong performance in the Pacific belly cargo sector and increased freighter revenue in the Americas. Although belly cargo and freighter revenue saw a dip in the Atlantic region, the overall cargo environment remained favorable. Air Canada reported that its 767 freighter operations exceeded expectations, with its right-sized network and commercial model yielding robust financial results. As of September 30, Air Canada has six Boeing 767 freighters in service and has adjusted its freighter fleet plans. Additionally, Air Canada reached a new four-year collective agreement with the ALPA union, averting a potential strike.

C.H. Robinson Worldwide Posts $13.54 Billion Revenue for First Three Quarters

C.H. Robinson Worldwide has released its Q3 financial results, reporting cumulative revenue of $13.54 billion for the first three quarters of 2024, a year-over-year increase of 1.24%. Net income for the period reached $320 million, up 7.6%. For Q3 2024 alone, C.H. Robinson reported operating revenue of $4.64 billion, a 7.0% increase year-over-year, and net income of $97.2 million, up 18.6%.

Qatar's Port Trade Volume Surges in October

In October 2024, Qatar's Hamad, Doha, and Ruwais ports experienced rapid growth in trade volume. Data shows a total of 259 vessel calls, up 4.02% month-on-month. Container throughput reached 131,608 TEUs, a 10.18% year-on-year increase, and Ro-Ro throughput rose by 149.26% year-on-year with 16,187 units. General and bulk cargo volumes were up 94.77% year-on-year at 151,663 tons. Hamad Port, as a major hub, has processed over 10 million TEUs, supporting growth in Qatar's automotive industry. Livestock throughput was at 40,661 head, showing a month-on-month increase of 43.42%. Notably, construction materials transport was not reported this month, although 264,719 tons have been processed to date.

Port of Melbourne Sees Increase in Container Throughput in September

In September 2024, container throughput at the Port of Melbourne rose to 284,000 TEUs compared to the same month in 2023. Full container imports (excluding Bass Strait) increased, with furniture, household appliances, and cardboard among the top imports. Full container exports (excluding Bass Strait) also grew, led by notable increases in cotton, timber, hay, rice husks, animal feed, and wheat exports. However, total empty container throughput in September saw a decline compared to the same month last year.

Maersk Reports Q3 Revenue at $15.8 Billion

On October 31, Maersk reported Q3 revenue for 2024 at $15.8 billion, up from $12.1 billion the previous year, with EBITDA at $4.8 billion (up from $1.9 billion) and EBIT at $3.3 billion (up from $538 million). Maersk projects its full-year EBITDA to be between $11-11.5 billion and EBIT between $5.2-5.7 billion.