Please Sign in to view recently saved searches.

Home

Media

Product Analysis

January 2025 Monthly Report on Phosphoric Acid and Downstream Industries in China

10 Feb 2025

January 2025 Monthly Report on Phosphoric Acid and Downstream Industries in China

Keywords

I. Market Analysis and Forecast: Divergent Trends in the Phosphoric Acid Market in January

1.1 Market Analysis

1.1.1 Market Analysis: Local Thermal Phosphoric Acid Prices Rise Slightly, Wet-Process Acid Prices Remain Firm

The phosphate market in January showed signs of divergence. In the thermal phosphoric acid sector, the price of yellow phosphorus initially increased and then stabilized. Some regions saw a slight increase in thermal phosphoric acid prices. As the year-end approached, downstream stocking activities neared completion, resulting in a slowdown in transactions. Additionally, some thermal phosphoric acid production facilities shut down for maintenance, leading to lower production capacity.

- Southwest China: Industrial-grade wet-process phosphoric acid (delivered) was priced at CNY 6,550–6,850/ton.

- Jiangsu Province: Purified wet-process phosphoric acid (delivered) ranged from CNY 6,970–7,050/ton.

- Central China: Industrial-grade wet-process phosphoric acid (ex-factory) was between CNY 6,550–6,600/ton.

- Sichuan Province: Thermal phosphoric acid (ex-factory) ranged from CNY 6,550–6,700/ton.

- Yunnan Province: Thermal phosphoric acid (ex-factory) ranged from CNY 6,750–6,800/ton.

For wet-process phosphoric acid, most factories maintained sufficient orders and faced no immediate selling pressure. Leading manufacturers of iron phosphate and lithium iron phosphate operated at high capacity, ensuring stable demand for purified wet-process phosphoric acid. Low inventory levels contributed to a supply-demand imbalance, driving up market transaction prices.

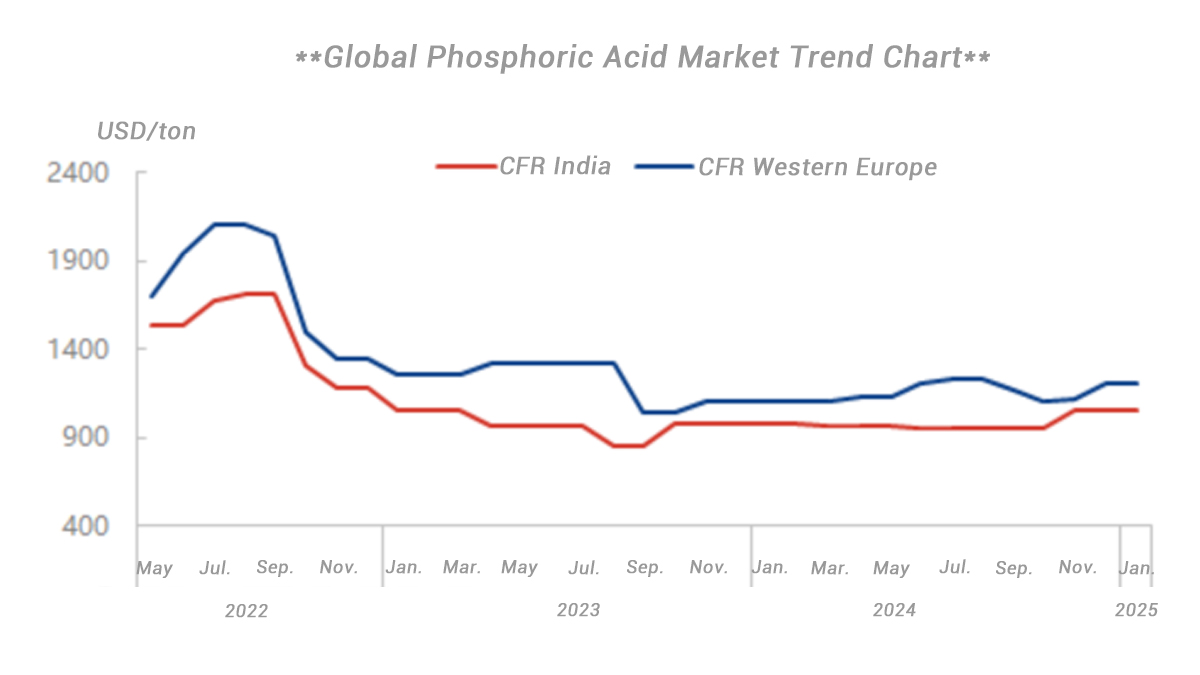

1.1.2 International Market Analysis: January Phosphoric Acid Export Prices Remain Stable

Monthly Event Review (Chronological Order)

First Week:

- India:

- A total of 251,000 tons of phosphoric acid solution arrived in India in January, with an additional 63,000 tons scheduled for delivery by the end of the month.

- Major sources: 90,000 tons from Senegal, 78,000 tons from Morocco, 59,000 tons from Jordan, 42,000 tons from China, 31,000 tons from the U.S., and 15,000 tons from the Philippines.

- Total imports in 2024: 3.54 million tons, below the 2019–2023 average of 4.25 million tons.

- Morocco:

- 139,000 tons of phosphoric acid solution were scheduled for export from Jorf Lasfar in January, up from 50,000 tons in December.

- Key shipments: 30,000 tons to Pakistan, 19,000 tons to an unknown destination, and the rest pending loading.

- Total exports from Jorf Lasfar in 2024: 1.24 million tons.

- 10,000 tons of refined phosphoric acid were exported to Belgium earlier in the month.

Second Week:

- India:

- First-quarter phosphoric acid contract price negotiations were ongoing, expected to remain stable around USD 1,060/ton P2O5 CFR (same as Q4 2023).

- Fact issued a tender to purchase up to 12,000 tons of phosphoric acid, with a deadline of January 13. The shipment was required to contain 46–53% P2O5 and arrive at Cochin Port between February 25 and March 6.

- Total imports planned for January: 77,000 tons (historical January average: 354,000 tons).

- Sources: 31,000 tons from Morocco, 23,000 tons from China, 13,000 tons from Tunisia, and 10,000 tons from the Philippines.

- Bangladesh:

- BCIC closed a tender for 20,000 tons of 52–54% P2O5 phosphoric acid on January 1.

- Sun International submitted an offer at USD 617.76/ton, equivalent to USD 1,144–1,188/ton P2O5.

- South Africa:

- Import phosphoric acid price indications stood at ZAR 12,500/ton CFR Richards Bay (~USD 1,275/ton P2O5 equivalent).

- Morocco:

- 30,000 tons of phosphoric acid solution were shipped from Jorf Lasfar to Pakistan.

- An additional 70,000 tons were scheduled for loading before the end of January.

- December exports from Jorf Lasfar: 121,000 tons (49,000 tons to India, 25,000 tons to Pakistan, 19,000 tons to South Africa, 9,000 tons to the U.S., 19,000 tons to an unknown destination).

Third Week:

- India:

- Fact’s tender for 12,000 tons of phosphoric acid (closed January 13) received a bid from Agrifields but was not yet opened.

- Total January imports: 142,000 tons.

- Major sources: 40,000 tons from Jordan, 31,000 tons from Senegal, 31,000 tons from Morocco, 23,000 tons from China, 13,000 tons from Tunisia, and 4,000 tons from the Philippines.

- Indian importers settled Q1 phosphoric acid contract prices:

- Coromandel (CIL) and Jordan’s JPMC agreed on USD 1,055/ton P2O5, including a 30-day credit period.

- Senegal’s Indorama agreed to supply phosphoric acid at the same price.

- This price was USD 5/ton lower than the Q4 2023 contract price.

- Morocco:

- 70,000 tons of phosphoric acid solution left Jorf Lasfar, with 30,000 tons sent to India and 21,000 tons to Belgium.

- Another 50,000 tons were planned for shipment by the end of the month.

- Total January shipments from Jorf Lasfar: 75,000 tons (2024).

Fourth Week:

- Morocco:

- A supplier reported that 20 units of SSP (Single Super Phosphate) entered Geelong at USD 220–230/ton and were offered at AUD 420–425/ton (USD 263–266/ton) in the local market.

- Total planned phosphoric acid shipments for January: 120,000 tons (compared to 75,000 tons in January 2024).

- Major shipments: 30,000 tons to India, 21,000 tons to Mozambique.

1.1.3 Industry Chain Market Analysis: Mixed Price Trends in the Phosphoric Acid Industry Chain in January

Yellow Phosphorus

In January, the average market price of yellow phosphorus in Southwest China was 23,305 RMB/ton, reflecting a 2.02% month-on-month increase but a 0.27% year-on-year decrease.

- Supply Side: Many yellow phosphorus producers shut down for maintenance, leading to a noticeable decline in production. As a result, manufacturers were reluctant to sell at lower prices, and market prices gradually increased.

- Demand Side: In early January, downstream enterprises actively stocked up for the Lunar New Year, leading to strong market transactions. However, as the holiday approached, market activity slowed, and both buyers and sellers focused on fulfilling existing orders rather than making new transactions.

As of the time of writing:

- Yunnan, Guizhou, and Sichuan regions: Factory acceptance prices for purified phosphorus were around 23,500 RMB/ton, with actual new orders transacting at 23,300–23,400 RMB/ton. Specific prices were negotiated case by case.

Phosphate Rock

In January, phosphate rock production in Hubei and Sichuan entered the traditional off-season, while some northern enterprises gradually resumed operations but had not yet increased production significantly.

- Supply Side:

- During the Lunar New Year, mining operations were paused due to the suspension of explosives usage, leading to reduced production.

- Overall supply capacity remained limited in the short term.

- Demand Side:

- Major phosphate fertilizer producers had stockpiles for 2–3 months, reducing the need for immediate restocking.

- Demand for phosphoric acid, calcium phosphate salts, and industrial ammonium phosphate remained stable, partially offsetting the declining demand for phosphate rock from fertilizer producers.

- Imports:

- New import negotiations were limited.

- After Q4 2024, non-mainstream suppliers showed increased interest in selling to China, but due to the off-season, discussions remained tentative.

- Market Prices:

- Sichuan (Mabian region):

- 25% high-magnesium phosphate rock: 700–730 RMB/ton

- 22% grade: 530–540 RMB/ton

- Hubei:

- 28% grade (FOB, tax included): 980–1,000 RMB/ton

- 25% high-magnesium phosphate rock (FOB, tax included): 854 RMB/ton

- Guizhou (Weng’an region):

- 28% grade (FOB, tax included): 970 RMB/ton

- 31% phosphate concentrate: 1,050 RMB/ton

- Guizhou (Kaiyang region):

- 30% grade (FOB, tax included): 950–980 RMB/ton, with high-end prices exceeding 1,020 RMB/ton

- Yunnan:

- 22% grade (tax included): 420 RMB/ton

- 24% grade: 500–520 RMB/ton

- Northern China:

- 32–33% premium phosphate rock: 920–940 RMB/ton

Monopotassium Phosphate (MKP)

In January, MKP prices saw a slight decline.

- Cost Side:

- The prices of upstream raw materials remained stable, leading to limited cost fluctuations.

- Market Sentiment:

- Enterprises primarily focused on shipments to the Xinjiang market, while downstream buyers were cautious and adopted a buy-as-needed strategy.

- Market Prices:

- Due to regional and quality differences, prices varied, and transactions were mostly negotiated on a case-by-case basis:

- Guizhou (wet-process production): 8,200 RMB/ton

- Sichuan: 8,300 RMB/ton

- Xinjiang: Prices were more divergent, with delivered prices ranging 8,400–8,500 RMB/ton.

Sodium Tripolyphosphate (STPP)

In January, the STPP market remained stable, with prices fluctuating within a narrow range.

- Market Sentiment:

- The overall trading atmosphere was subdued, and downstream buyers showed low purchasing enthusiasm.

- Transactions were mainly focused on fulfilling existing orders.

- Market Prices:

- Sichuan (wet-process, industrial grade): 6,700–6,900 RMB/ton

- Shandong (industrial grade): 7,135–7,515 RMB/ton

- Due to differences in production processes, prices varied between regions.

Sodium Hexametaphosphate (SHMP)

In January, the SHMP market exhibited range-bound movement.

- Market Sentiment:

- Downstream demand remained tepid, and factories lowered their prices slightly due to slow sales.

- Factory operating rates decreased as producers encountered difficulties in selling their output.

- Market Prices:

- Southwest China (industrial grade): 8,100–8,300 RMB/ton

- Shandong: 8,100–8,500 RMB/ton

- Due to regional production differences, prices varied.

Iron Phosphate (FePO₄)

In January 2025, anhydrous iron phosphate prices slightly increased.

- Market Prices:

- Mainstream transaction prices: 10,000–11,000 RMB/ton

- Top-tier manufacturers' quotes: Above 11,500 RMB/ton

- Some new market players offered lower prices.

- Cost Side:

- Wet-process phosphoric acid supply remained tight, supporting price increases.

- Industrial-grade monoammonium phosphate remained at high prices, while ferrous sulfate supply tightened, suggesting potential further price hikes.

- Demand Side:

- January demand weakened slightly due to holiday logistics disruptions.

- Manufacturers focused on fulfilling existing orders, with some planning maintenance shutdowns around the Lunar New Year.

- Processing fee adjustments in the battery industry limited further price increases, leading to a more cautious market outlook.

- Supply Side:

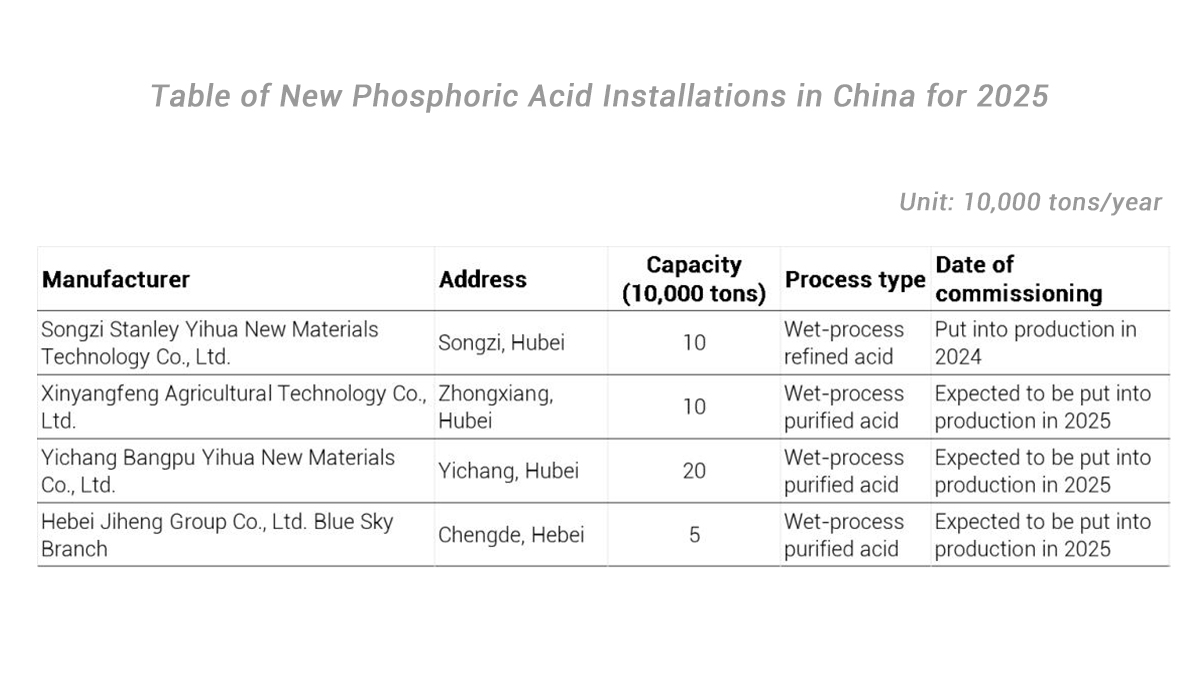

- New production capacity expansions are expected, which could increase overall supply in the market.

1.2 Market Forecast: February 2025 Phosphoric Acid Production Slightly Declines, Wet Acid Prices Stay Firm

1.2.1 Fundamental Forecast: Phosphoric Acid Fundamentals Expected to Remain Stable in February 2025

1.2.1.1 Production Forecast: Phosphoric Acid Output Expected to Decline in February 2025

In February, due to the Spring Festival holiday, some wet-process acid manufacturers will shut down for maintenance, resulting in a reduction in supply. For wet phosphoric acid, there is a slight decrease in supply as production levels decrease. However, due to the ongoing demand from the downstream phosphoric acid iron sector, it is reported that phosphoric acid iron producers are maintaining relatively high operating rates, and leading manufacturers are continuing normal production during the holiday, having prepared inventories in advance to ensure production continuity. After the holiday, the price of wet phosphoric acid is expected to maintain its current levels, while demand for thermal phosphoric acid is moderate and may fluctuate with raw material prices.

1.2.1.2 Consumption Forecast: There Will Be Steady Demand for Phosphoric Acid in February 2025

For downstream phosphoric acid iron, two major deliveries are driven by earlier orders, and overall production remains relatively stable. Manufacturers are showing a strong stance in keeping prices firm. Meanwhile, raw material prices remain high, and it is expected that the price of anhydrous phosphoric acid iron will remain stable, with iron-lithium prices likely fluctuating with raw material trends.

1.2.1.3 Import and Export Forecast: Phosphoric Acid Exports Expected to Decline in January

It is expected that phosphoric acid exports will decrease in January compared to previous months, with imports remaining negligible and exports estimated at around 11,500 tons.

1.2.2 Cost Forecast: Outlook for the Post-February 2025 Market

1. Phosphate Rock: The phosphate rock market price remained stable before and after the Spring Festival, with limited new transactions. The downstream phosphate fertilizer market has not yet begun large-scale procurement, but after the holiday, major phosphate fertilizer manufacturers are expected to release replenishment demand, though prices are expected to remain stable. Focus is on downstream fertilizer procurement in China and phosphate fertilizer export policies.

2. Yellow Phosphorus: It is expected that after the holiday in February, the yellow phosphorus market will remain in a wait-and-see mode, with supply-demand balance. Prices may stabilize at first and then gradually decline. The main factors are that during the holiday, some yellow phosphorus producers maintained normal production, increasing industry inventory, while smaller producers still face pressure to sell, which could negatively affect price discussions. Moreover, downstream businesses have slow recovery in operations, and with the low price of liquid chlorine at the end of January, the operating rate of phosphorus trichloride manufacturers increased significantly, resulting in high inventory and a cautious approach to raw material purchases post-holiday. Phosphoric acid and glyphosate manufacturers indicate that short-term operations will focus on consuming existing inventory and fulfilling orders, while the demand side is expected to remain cautious. As a result, substantial price increases post-holiday are unlikely.

3. Sulfuric Acid: The Chinese sulfuric acid market in February is expected to remain stable. After the Spring Festival, sulfuric acid plant inventories in China have not changed significantly, with steady delivery during the holiday. Although supply remains sufficient, there is no significant pressure. Downstream fertilizer demand is subdued, and the start of spring plowing season remains uncertain. Chemical industry recovery will also depend on future demand trends. In the short term, both supply and demand sides are expected to be weak, with limited price fluctuations.

1.2.3 Market Sentiment Survey: February 2025 Phosphoric Acid Market Outlook Generally Stable

As of February 5, 2025, a sentiment survey on the Chinese phosphoric acid market showed that 13% of participants were bearish, 55% were neutral, and 32% were bullish. The bullish sentiment is attributed to good market performance in the downstream new energy sector, as well as stable supply of wet phosphoric acid. The neutral sentiment is due to stable phosphate rock prices, providing steady support on the raw material side. The bearish sentiment comes from weak demand for traditional phosphates, resulting in limited market support.

II. Fundamental Analysis: Phosphoric Acid Industry in January Faces Tight Supply

2.1 Production: Phosphoric Acid Industry Sees Increase in Output in January

2.1.1 Capacity Utilization: Phosphoric Acid Industry Capacity Utilization Slightly Increases in January

2.1.2 Output and Capacity Utilization:

In January, China's phosphoric acid plants produced 292,800 tons, an increase of 19,000 tons from the previous month, marking a 6.93% month-on-month rise. The overall monthly capacity utilization rate was 53.20%. Wet-process purified acid output in January was approximately 208,100 tons, with an average plant operating rate of 65.08%. Thermal phosphoric acid output in January was around 84,700 tons, with an average plant operating rate of 36.88%.

2.2 Consumption: Downstream Phosphoric Acid Demand in January Shows Mixed Support, Apparent Consumption Expected to Decrease Slightly

In December 2024, the apparent consumption of phosphoric acid was 239,900 tons, up 7.48% from November. In January, apparent consumption is expected to be around 220,000 tons, with a slight increase in export orders compared to December. The overall demand for apparent consumption is expected to show a slight upward trend.

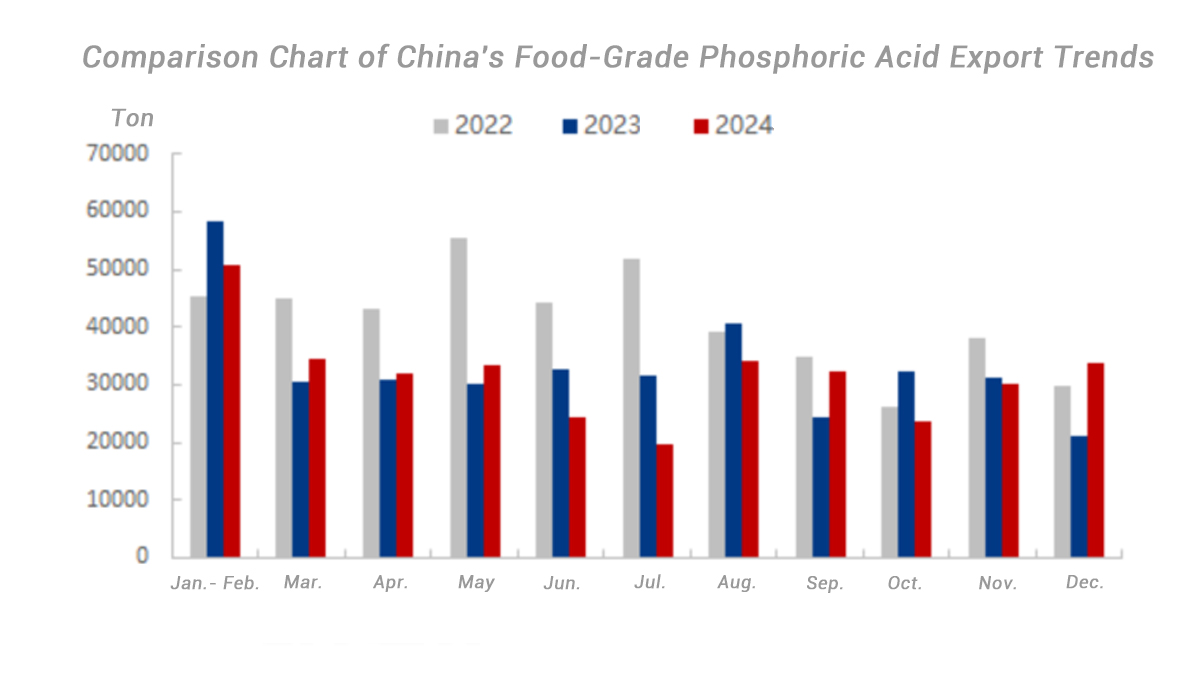

2.3 Import and Export: December Exports of Food-Grade Phosphoric Acid Increased

2.3.1 Import and Export: In December 2024, China’s food-grade phosphoric acid exports totaled 33,900 tons, a 12.13% increase month-on-month.

2.3.2 Export: China’s food-grade phosphoric acid export value in December 2024 amounted to 33.1 million USD, up 12.64% from the previous month, with an average export price of 976.50 USD/ton, up 0.46%.

III. Profitability: Phosphoric Acid Industry Profitability in January

3.1 Gross Profit: January Phosphoric Acid Production Gross Profit

In January, the average gross profit of thermal phosphoric acid in East China was 1.66 CNY/ton, a decrease of 66.59 CNY/ton from December, showing a month-on-month decrease of 0.97%. The calculated product cost was 6,872 CNY/ton, up 1.62% from the previous month.

In Southwest China, the average gross profit for wet-process phosphoric acid was 852.18 CNY/ton, down 3.40% from December, with the product cost at 5,716 CNY/ton.

Disclaimer: Blooming reserves the right of final explanation and

revision for all the information.