Please Sign in to view recently saved searches.

Home

Media

Trade Information

Announcement from China's Ministry of Finance: Adjustment to Export Tax Refund Policies

18 Nov 2024

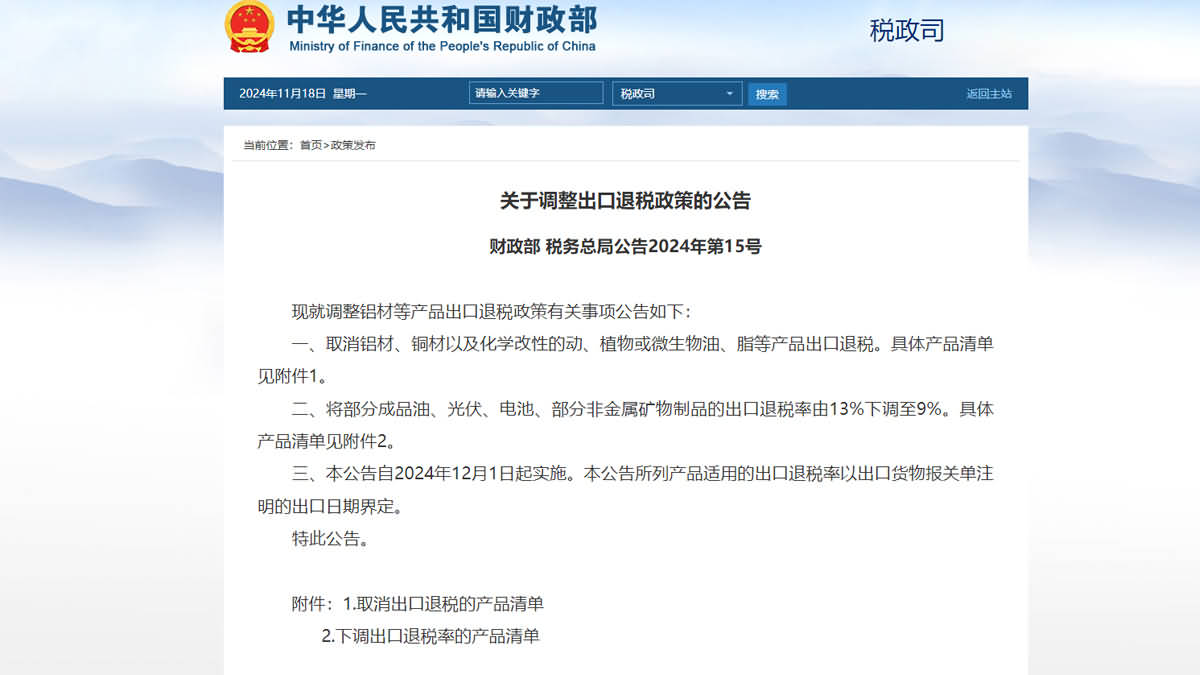

Announcement from China's Ministry of Finance: Adjustment to Export Tax Refund Policies

Keywords

On November 15, China's Ministry of Finance and State Taxation Administration issued an announcement regarding adjustments to the export tax rebate policy for products such as aluminum and related materials:

1. Elimination of Export Tax Refunds

Export tax refunds will be canceled for products such as aluminum materials, copper materials, and chemically modified animal, vegetable, or microbial oils and fats.

2. Reduction in Export Tax Refund Rates

The export tax refund rate for select products, including certain refined petroleum products, photovoltaic components, batteries, and specific non-metallic mineral products, will be reduced from 13% to 9%.

3. Implementation Date

These adjustments will apply to exports declared on or after December 1, 2024, based on the export date indicated on the customs declaration.

Impact Analysis

Will China's Removal of Raw Material Export Tax Refunds Benefit the Bioenergy Sector?

The removal of export tax refunds for Used Cooking Oil (UCO) is expected to weaken the cost-effectiveness of exporting such materials, potentially reversing the recent surge in UCO exports. For China's domestic downstream companies, this policy translates to reduced raw material costs, while competitors abroad face higher comprehensive raw material costs. Consequently, Chinese bioenergy companies are likely to see strengthened global competitiveness.

In the long run, Chinese bioenergy enterprises with access to raw material supplies are poised to gain significant advantages. Additionally, these companies are likely to benefit from increased policy support. Stakeholders should pay close attention to biodiesel and biojet fuel processors already sourcing or planning to source UCO within China.

Does the Removal of Tax Refunds Signal a New Era for Copper and Aluminum Processing in China?

This policy adjustment affects 94% of China's aluminum exports and 50% of copper exports, with broad implications.

Short-Term Impact:

Pressure on China's aluminum and copper supply-demand balance.

Downward pressure on domestic prices.

Overseas prices and processing fees are expected to rise due to high dependence on Chinese exports, creating opportunities for Chinese exporters to expand internationally.

Long-Term Impact:

The convergence of domestic and international prices is likely to stabilize China's aluminum and copper markets.

Capacity optimization is anticipated to benefit leading aluminum and copper processing enterprises in China.

This policy shift marks a strategic move to bolster the competitiveness of domestic processing industries while rebalancing global market dynamics.

Disclaimer: Blooming reserves the right of final explanation and

revision for all the information.